Paint Market in Latin America 2024

The paint market in Latin America, including Central America and the Caribbean, represents a vibrant and expanding industry. This report details market figures, growth rates, and global trends with a focus on the specific opportunities and challenges in the region.

Market Analysis

The paint and coatings market in Latin America is valued at approximately USD 8.32 billion in 2024 and is projected to reach USD 11.00 billion by 2029, with a compound annual growth rate (CAGR) of 5% (Expert Market Research) (Research & Markets).

Market Segmentation

- By Technology Type:

- Water-Based Paints: 45%

- Solvent-Based Paints: 30%

- Powder Coatings: 15%

- UV Paints: 10% (Expert Market Research).

- By Application:

- Architectural: 55%

- Automotive: 20%

- Industrial: 15%

- Wood and Transportation: 10% (Expert Market Research).

Per Capita Paint Consumption by Country

Per capita paint consumption in Latin America varies by country, but on average, it ranges between 6-10 liters per person per year. Here are the most recent and reliable data from the main countries in the region:

- Brazil: Approximately 10-12 liters per capita.

- Mexico: Around 8-10 liters per capita.

- Argentina: About 7-8 liters per capita.

- Chile: Approximately 6-7 liters per capita.

- Colombia: Around 5-6 liters per capita.

- Peru: About 4-5 liters per capita.

- Ecuador: About 4-5 liters per capita.

- Bolivia: Approximately 3-4 liters per capita.

- Central America and the Caribbean: approximately 4 liters per capita.

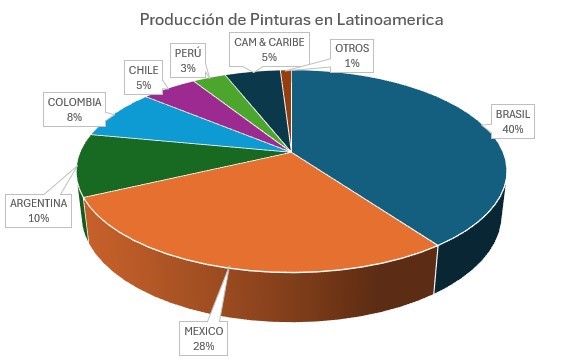

Paint Production by Country in Latin America

Sources This information comes from market studies and reports from reliable sources such as Mordor Intelligence and Fortune Business Insights, which analyze the latest trends and statistics in the paint and coatings industry in Latin America (Mordor Intelligence) (Fortune Business Insights) (Research Markets).

Cost Analysis

Production Costs Production costs in the paint market include raw materials, labor, energy, and manufacturing expenses. Below are the main components and their impact on total cost:

- Raw Materials: They account for approximately 50-60% of the total production cost. They include resins (acrylic, alkyd, epoxy, polyurethane), pigments, solvents, and additives. Raw material prices can fluctuate significantly due to market conditions and transportation costs.

- Labor: Represents around 10-15% of the total cost. It includes wages and benefits for production workers, supervisors, and quality personnel.

- Energy: Approximately 5-10% of the total cost. It includes electricity and natural gas used in the manufacturing process.

- Manufacturing Expenses: These include indirect costs such as machinery maintenance, equipment depreciation, and insurance, representing 10-15% of the total cost.

Distribution Costs Distribution costs cover storage, transportation, and logistics to bring products to market. These costs can represent 10-20% of the final product price. Logistical challenges in some regions of Latin America can increase these costs.

Market Trends

Technologies

- Water-Based Paints: Preferred for their low volatile organic compound (VOC) content and high corrosion protection, they are widely used in architectural and automotive applications (Expert Market Research).

- Powder Coatings: Used for their durability and scratch resistance, popular in architectural and industrial applications (Mordor Intelligence).

- Solvent-Based Paints: With faster drying times and efficiency in demanding conditions, they remain in demand for exterior applications (Expert Market Research) (Mordor Intelligence).

Consumer Preferences Consumer preferences in the paint market in Latin America are influenced by several key factors, including economic growth, design trends, environmental awareness, and technological innovations. Below are some of the main preferences and trends observed in the region:

Preference for Eco-Friendly and Sustainable Products

- Water-Based Paints: Consumers are increasingly aware of the environmental impact of the products they use. Water-based paints, which have low VOC content, are preferred due to their lower environmental impact and lower toxicity.

- Eco-Certifications: Products with eco-certifications and green labels, such as those indicating low VOC, are gaining popularity. Consumers seek products that are safe for the environment and for the health of their families.

Innovation

- Digitalization and Color Selection Tools: Digital innovations, such as color matching apps and augmented reality tools, allow consumers to visualize how colors will look in their homes before purchasing. This has significantly improved the shopping experience.

- New Formulations: Advances in paint formulations, such as antimicrobial and self-cleaning paints, are attracting consumers who seek additional features beyond color and durability.

Aesthetics and Personalization

- Design Trends: Global interior design trends influence paint color preferences. Neutral and natural colors, as well as bold and vibrant colors, are in demand according to current fashion.

- Personalization: Consumers value the ability to customize their spaces. Companies that offer a wide range of colors and finishes, as well as custom color mixing services, are better positioned to capture this demand.

Quality and Durability

- Long-Lasting: Consumers prefer paints that offer good coverage and durability, reducing the need for frequent repainting. Stain resistance and ease of cleaning are valued features.

- Trusted Brands: Brands with an established reputation for quality and reliability have a competitive advantage. Consumers often prefer to pay a little more for products they know will meet their expectations.

Cost and Accessibility

- Value for Money: While consumers are willing to pay more for high-quality and eco-friendly products, value for money remains a determining factor. Promotions and discounts can significantly influence purchasing decisions.

- Availability: Product accessibility in physical stores and online also plays an important role. Consumers prefer brands and products that are easily available in their area.

Market Segments

- DIY Market: There is a growing segment of consumers who prefer to do renovations and decorations themselves. This group values easy-to-apply paints with clear instructions and professional results.

- Professionals: Professional painters and contractors seek products that offer efficiency in application and long-lasting results. Companies that can provide technical support and training also gain the loyalty of this segment.

Changes in Consumer Behavior

- Seeking More Affordable Alternatives: Consumers may opt for more affordable brands or look for promotions and discounts to offset price increases.

- Reduction in Renovation Spending: During periods of high inflation, consumers tend to prioritize essential expenses and may postpone or cancel home renovation projects.

Impact on Sales

- Decline in Sales Volumes: Price increases and reduced purchasing power may lead to a decrease in paint sales volumes.

- Affected Segments: The most price-sensitive market segments, such as DIY and residential, may see a more significant reduction in sales compared to commercial and industrial segments, which may have more capacity to absorb additional costs.

Mitigation Strategies

- Operational Efficiency: Manufacturers can seek to improve operational efficiency and reduce costs in other areas to minimize price increases for consumers.

- Innovation and Added Value: Offering products with additional features, such as low VOC, antimicrobial, or self-cleaning paints, can justify higher prices and maintain demand.

- Promotions and Discounts: Promotions and discounts can help attract consumers looking for more affordable options during periods of high inflation.

Conclusion

Consumer preferences in the paint market in Latin America are evolving towards more sustainable, technologically advanced, and personalized products. Companies that can respond to these trends with innovative, high-quality products are better positioned to capture and retain these consumers. The combination of quality, durability, aesthetics, and sustainability will be key to meeting market expectations.